Canadian dollar

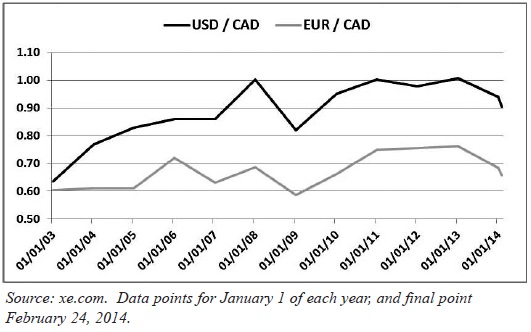

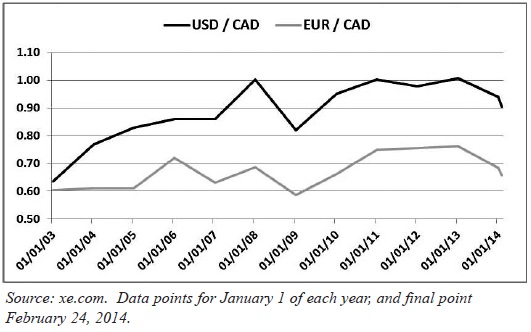

Canadian’s have been spoiled with a strong Canadian dollar (CAD) over the past decade – for the most part making cross border shopping and travel outside of Canada much more affordable. The CAD appreciated from $0.63 USD per $1.00 CAD on January 1, 2002 to $0.98 USD per $1.00 CAD on January 1, 2012 and to $1.01 USD per $1.00 CAD on January 1, 2013. This tremendous run up was supported by several factors, including a strengthening Canadian economy, higher interest rates and strengthening commodity prices.

By December 6, 2013, $1.00 CAD traded at almost $1.07 USD. The strength of the CAD outside of the benefits that we mentioned above also played a detrimental role in the weakness of the Canadian economy – stubbornly high unemployment rates and less than competitive industrial sector (Ontario and Quebec). Then the CAD began to reverse this trend, as it began to climb down fairly aggressively relative to the USD over the past 8 weeks or so. The negative trend of December 2013 to February 2014 was also quite noticeable for the CAD relative to the EUR.

In December 2013, CAD weakness began to accelerate, with the decline particularly steep in January 2014 when the dollar dropped to almost 89 US cents.

Focusing on the CAD:USD relationship, a major reason for the CAD depreciation can be linked to the relative weakness of the Canadian economy compared to the U.S. economy. As well, commodity prices have suffered weaknesses, as China’s economy tries to manage a controlled landing.

Another factor affecting the exchange rate of the Canadian dollar, interest rates, also points to the lower dollar. Since April 2012 up until October 2013, the Bank of Canada issued several warnings that it would raise interest rates. In October 2013, it abandoned these warnings. In January 2014, there even were speculations that the Bank of Canada may cut interest rates.

With inflation remaining low (under 1.5% on an annual basis), unemployment high (over 7%) and economic activity anemic, interest rates are expected to remain low.

That said, the Canadian economy has seen some improvements. The Bank of Canada expects that in the fourth quarter of 2013 the GDP will post a 2.5%-3% growth in annual terms. This is rather good growth, slightly lower than the pace of recovery in the USA where the GDP rose 3.2% in the fourth quarter.

For the 2013 year, the Bank of Canada expects that the GDP will grow by 1.8%. The growth should pick up and for both 2014 and 2015 the Bank expects 2.5% growth. At the same time, the Bank of Canada in January 2014 lowered its expectations for inflation. The Bank expects that inflation will rise gradually to its 2.0% target by late 2015.

Low interest rates have driven down the yields of Canadian government bonds. The five-year bond yield dropped from 2.77% in early 2011 to around 1.60% currently. The spread between five-year Canadian and U.S. government bonds is currently below 10 basis points (0.1%), down from about 60 basis points in early 2013.

Prominent Canadian economists expect that this situation will persist in 2014 which could drive the CAD still lower. TD Bank’s chief economist Craig Alexander expects that commodity prices this year will be flat which will lead to Canada’s economy underperforming the United States’ economy. As a result, the Canadian dollar may decline to $0.85 USD by mid-2014.

Benjamin Reitzes, senior economist at BMO Capital Markets, has recently issued a similar forecast. He expects that the CAD will fall to $0.87 USD later this year and bounce back to $0.90 USD or higher towards the year-end.

Low inflation and low interest rates should benefit Canadian debtors, as financial institutions maintain low interest rates on loans. However, that would also mean that GIC rates would also remain very low, as they currently are.

While exporters and debtors are benefiting from low interest rates and a weak CAD, Canadians investing or travelling abroad are losing out. TD Bank’s Craig Alexander believes that the boost for exports from the low CAD will compensate for these losses, improving Canada’s trade balance.

Michael Zienchuk, MBA, CIM

Investment Advisor,

Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

mzienchuk@ukrainiancu.com

www.ukrainiancu.com